Key Figures for the Fashion Sector in 2021-2022

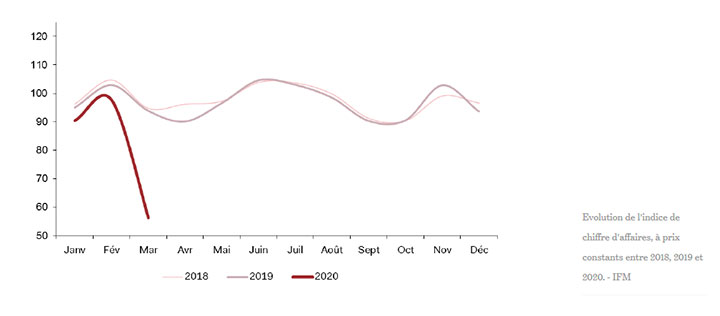

Hit hard by the coronavirus crisis, the fashion market will experience a sharp decline in sales in France and abroad in 2020.

However, fashion is still the leading market on the Internet in terms of the number of buyers. In 2020, according to Fevad (Federation of e-commerce and distance selling), 51% of products and services purchased on the web will be in the clothing sector.

The share of e-commerce in the global fashion trade represents 14.7% for a total of 4 billion euros in turnover; a statistic that is constantly increasing.

In order to know more about the evolution of the sector, and the growing importance of the web for its actors, here are some key figures of the fashion market in 2021-2022.

Overview of the fashion market in France and internationally in 2021-2022

Until the health crisis of 2020, the fashion and apparel industry was doing well. According to the predictions of Kantar, a consulting firm specializing in market research, the global market is expected to grow at an annual rate of 3.9% until 2025.

This was without taking into account COVID-19, which led to a drastic drop in sales of fashion items in all product categories.

In France, the positive projections have therefore had to be revised downwards:

- The IFM (Institut Français de la Mode) is now forecasting a drop in sales of between -17% and -25% for the year 2020, depending on the speed of the recovery in consumption.

Still according to the IFM, in a general way, the share devoted to clothing has been decreasing in the global budget of the French since the 1960s. The first to be impacted by these purchasing behaviours are the physical stores:

- In the first half of 2019, shops were already cashing in on a 2.6% year-on-year decline in sales; while online sales were up 4.2%.

- During the crisis, physical sales suffered even more, falling by 18.7%, compared with 6% for online sales.

Fashion in 2021-2022: the post-health crisis

According to Fashion network, Fevad announces that “fashion, which has long been among the most ordered products on the Internet, is one of the sectors whose sales have suffered the most from the Covid crisis”.

Indeed, the figures speak for themselves. In March 2020, e-commerce sales in the fashion sector have largely declined. It was noted that activity dropped by 30% in the first week of containment and did not recover until mid-April. This statistic suggests that the French do not consider fashion to be an essential purchase in times of crisis.

Panorama of the fashion market on the web in 2021-2022

Despite the impact of the crisis on the state of the market, the fashion sector still seems to have a bright future ahead of it, especially on the web. The proof is in the figures announced by Kantar Worldpanel on behalf of Fevad:

- 40% of French people ordered a fashion item online in the first three months of 2019 ;

- each customer spent an average of 150 euros;

- total web spending for the fashion industry has reached three billion euros in six months;

- with an order intake of approximately 70 million.

Fashion players on the Internet in 2021-2022

The journal du net returns on a study of the Xerfi group, on the fashion market in France, which dissociates the various typologies of online sales in France:

- click and mortar ;

- veadists ;

pure player

.

The

click and mortar

have the greatest weight in fashion e-commerce. Who are they? These are companies that combine in-store distribution with Internet sales. According to Xerfi and IFM, in 2016 they accounted for just over 38% of online sales.

However, their turnover from this source rarely exceeds 10% of their annual total. For example, in sportswear, Decathlon only achieved 4% of its turnover on the Internet in 2017 and Intersport only expects to achieve 5% in 2020.

The

veadists

are just behind with a 35.9% share of the online fashion market. These are the brands that in the past only sold by mail order through a catalogue. Overall, they have struggled with competition from pure players and are struggling to make a go of it. The 3 Suisses recorded an 87% drop in turnover between 2004 and 2016. La Redoute, on the other hand, has largely recovered thanks to its purchase by Galeries Lafayette in 2018.

However, the

pure players

come last in the ranking. Web-only companies have only 26% of the market share.

The leaders of the ranking remain difficult to establish, as few companies reveal their strategy and results. Le journal du net proposes to give a trend based on their audiences. Here are the top 3 e-tailers:

- Amazon, with more than 100,000 visitors in France per month;

- Cdiscount ;

- and eBay with between 30,000 and 100,000 visitors.

Concerning the specialized sites :

- The company Veepee (formerly Vente-privée) is well ahead with nearly 30 million visits per month;

- followed by Showroomprivé with about 14 million;

- followed by La Redoute with 12.5 million ;

- Decathlon ;

- and Zalando.

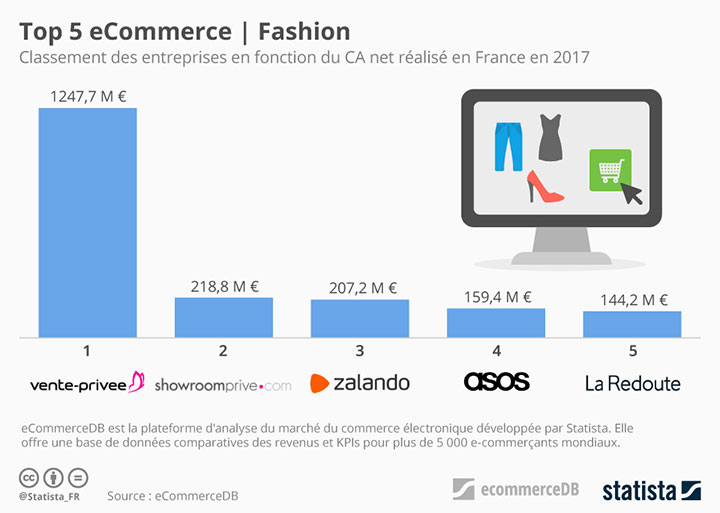

Statista, thanks to the figures of its platform eCommerceDB, determined a top 5 of the fashion e-commerce sites which realized the most important sales figures in France these last years. It confirms the trends mentioned above:

- Vente-privee.com is well ahead of the pack with more than one billion euros in turnover;

- Showroomprivé;

- Zalando;

- Asos;

- La Redoute is actually present in 5th position.

Why is Veepee way ahead of the others?

Clothing sales remain subject to household budgets, as this category of expenditure is not seen as a priority; a trend confirmed by the decline in purchases of fashion items throughout the crisis period in 2020. Sales and promotions on the web play an essential role in the sales of e-commerce. Indeed, according to the IFM, 58% of total sales are made on discounted products.

Millennials will still be the leading consumers of fashion items in 2021-2022

Millennials, otherwise known as Generation Y, are young people born between 1984 and 1996. This is an important segment of the clothing industry’s Internet customers.

According to the Kantar study, they spend 19.5% of their total budget on this item. In comparison, seniors spend only 10%.

Fashion transactions on the web for young people continue to rise, with a 17% increase in the first three months of 2019.

The top 5 fashion e-commerce sites for the under 35s are :

- Zalando;

- Veepee;

- Amazon;

- H&M;

- Showroomprivé.

The other concrete characteristic of this clientele is its more volatile behaviour compared to older people:

- they frequent about 7 different brands;

- they use loyalty cards less;

- they buy a lot of items on sale;

- they love second-hand clothes, 47% of Vinted purchases are made by millennials.

The fashion market seems to have a bright future on the Internet. Brands are becoming increasingly aware that their presence on the web is essential. On the other hand, the customers, mostly young, show that this new way of consuming is already well established.

If you want to know more about the strategies to adopt to anchor your brand of ready-to-wear, shoes, bags or accessories, our agency Alioze is specialized in fashion communication.

Read also our article on the key figures for the fashion sector in 2020 (in French)

See also:

- Key figures of the beauty sector

- Key figures for the luxury sector

- Key figures for the fashion sector

- Key figures for the tourism sector

- Key figures for the food sector

- Key figures for the health sector

- Key figures for the real estate sector

- Key figures for the watchmaking sector

- Key figures for the education and teaching sector

- Key figures for the lawyers’ sector

- Key figures for the culture sector

- Key figures for the automotive sector

- Key figures for the wine and spirits sector

- Key figures for the children and youth sector

- Key figures for the hotel sector

- Key figures for the jewellery sector

Sources:

-

- journaldunet.com:

- ecommercemag.com :

- en.fashionnetwork.com :

- en.statista.com :

- fevad.com:

Leave a Reply

You must be logged in to post a comment.