How to maintain and develop your business in times of Coronavirus / crisis?

Attack, humanitarian disaster, yellow vest movement and now the Coronavirus… So many periods of “crisis” that have commercial and economic consequences in the more or less long term.

For merchants, specifically, one question arises:

Is the impact of these crisis situations the same for e-commerce and physical commerce?

Whether they are tragic (terrorist attacks, humanitarian or natural disasters), social (election periods, social unrest, etc.) or cultural (sports competitions, etc.), major media events have a short-term impact on e-commerce traffic. Under the influence of emotion, cyber shoppers tend to abandon online sales sites and go to social networks and news sites to follow events in real time.

In the event of a tragic event, the repercussions extend over a longer period. After the Charlie Hebdo, November 13 or Nice attacks, frightened consumers were less likely to leave their homes, go to the store, do outdoor activities or travel. Physical stores, hotels and restaurants have been hit hard by this phenomenon, which has resulted in a drop in customer traffic and, as a knock-on effect, a drop in sales or reservations.

With the Coronavirus, it is still another situation, completely new, which the companies, independent or craftsmen must face. The country being at a standstill and the so-called “non-essential” shops being forced to lower their curtains, we can assume that consumers will have no other choice than to go online to make their purchases and, above all, that they will have more time to do so. Will there be a shift in sales from traditional stores to the Internet? Could e-commerce be the big “winner” of the Coronavirus and other crisis periods?

While the web represents a viable opportunity for locally based businesses to stay afloat, it is not as obvious.

In order to see more clearly, let’s take a look at the repercussions on trade that the main “crisis” situations of the last few years (attacks, yellow vest movements) have had.

We then offer you a small guide to make your business survive in times of Coronavirus.

Impact of the yellow vests on local commerce

Demonstrations, Saturday closures, roadblocks and blockades of store entrances have affected the turnover of many local traders.

The first national mobilization of the yellow vests took place on November 17, 2018, less than two weeks before Black Friday, an American-style promotional operation that usually kicks off the holiday shopping season.

After this first act, the demonstrations were repeated throughout the month of December, and then throughout the year, both in the major cities and in the provinces.

As a result, small shops and supermarkets have been hit hard. The impact of these successive sales weekends was significant, especially since December is usually the most prosperous time of the year.

Agnès Pannier-Runacher guest on BFM TV on 22 December 2018

Questioned on the set of BFMTV, Agnès Pannier-Runacher, Secretary of State for the Economy, estimated an average loss of business of 25% for shops.

As for the drop in the number of visitors to shops, peripheral centres and shopping centres, it ranged from 15 to 25%.

The financial losses have affected all sectors of activity: fashion boutiques, hypermarkets, toy shops, perfume shops, florists, wine shops, hotels, restaurants, etc. But the damage was even greater for three types of shops:

- Merchants specializing in the sale of perishable products, who have lost their merchandise and could not postpone selling it.

- The shopkeepers located in the heart of the grumble, forced to lower the curtain on some Saturdays to avoid looting and damage to their outlets.

- Hotels that have endured cancellations from tourists frightened by the sometimes violent images of certain demonstrations.

The yellow vest crisis has also led to other collateral victims: suppliers sometimes unable to deliver the goods, or employees, prevented from working.

Impact of the attacks on local commerce

Since the terrorist attack on Charlie Hebdo, the sad list of attacks in France has led to a difficult economic situation.

According to the French National Institute for Statistics and Economic Studies (INSEE), the impact of the attacks on the economy is immediate. Spending, particularly in the hotel and restaurant sector, fell sharply in the quarter following the event. The good news is that they start up again the following quarter or, at worst, six months later.

Attacks on Charlie Hebdo, Montrouge and Hyper Cacher

The attack on Charlie Hebdo occurred on January 7, 2015, the launch date of the 2015 winter sales. Two days later, the hostage-taking in the Hyper Cacher at the Porte de Vincennes added to the prevailing psychosis. Results? The WL Panel reported a 17% decline in the number of sales compared to the previous year.

Paris attacks

Following the Paris attacks, shops recorded a drop in turnover ranging from 20% for shopping centres to 25% for department stores. In the week following the attacks, the number of visitors to city centre shops fell by 20 to 30% throughout France. Shops were not the only ones impacted by the tragic attacks of November 13, 2015: the entire economy came to a standstill in the weeks following the attack. On average, museums recorded a 30% drop in attendance. Theatres have lost up to 40% of their audience. And in tourism, all over France, overnight stays were down by 1.7% compared to November 2014 – a figure that climbs to 6.9% in the Île-de-France region.

Attack in Nice

After the attack that plunged the Promenade des Anglais into mourning on July 14, 2016, shopkeepers, restaurateurs and hoteliers in Nice and the Côte d’Azur, but also in all the tourist regions of France, suffered from a drop in attendance. The City of Angels, which welcomes 5 million visitors each year, suffered a drop of almost 20% in bookings in July and 27% in August compared to the previous year. The drop in tourism also means fewer potential consumers, and therefore also a lower balance sheet for retailers. One year after the attack, tourist numbers in Nice have more or less returned to normal. But many hoteliers had to charge low season rates to make the city attractive again.

Strasbourg attack

The attack on the Strasbourg Christmas market on 11 December 2018 resulted in a sharp drop in attendance of around 15% compared to the previous year. The market and some of the surrounding businesses remained closed for two days. They also suffered from the cancellations of tourists following the attack. According to Pierre Siegel, president of the Union des métiers et des industries de l’hôtellerie (UMIH) du Bas-Rhin: ” Cancellation rates in the first week were the same as those experienced in Paris in November 2015 and were higher than those in Nice in July 2016.”

Can e-commerce benefit from the Coronavirus and other crisis periods?

We can assume so.

Faced with a feeling of insecurity, the impossibility of accessing stores, the fear of being contaminated and the obligation to respect strict containment measures, the French are most likely to change their consumption habits.

This is also what emerges from the results of a survey conducted by the Federation of e-commerce and distance selling (Fevad) and the CSA institute on the buying behavior of the French during the end-of-year festivities in the midst of the yellow vest crisis. 21% of those surveyed claimed to have been impacted by the yellow vest movement, either by having to delay buying gifts or by cutting back on spending.

Yet, in the midst of the yellow vests crisis, online sales sites made €19 billion in sales over the Christmas period, €2.5 billion more than the previous year. La Poste, the market leader in parcel delivery in France, claimed to have delivered a total of 78 million parcels for Christmas 2018, 11% more parcels than in 2017.

However, these figures, however good they may be, must be qualified.

Indeed, the occurrence of a major event tends to dampen consumer morale. At the time, people lose the desire to buy… or prefer to postpone their purchases until later, when the crisis passes or fades away.

“Uncertainty generally causes consumers to save, not spend.”

Gary Becker, Nobel Prize-winning economist.

This ambient gloom is reflected in the figures for online sales.

Thus, according to François Momboisse, president of Fevad, the movement of the yellow vests would not have led to a massive postponement of purchases on the web, since the figures of online sales concurred with the established forecasts :

« There was no explosion of sales on the Internet at all […] We saw that people had their minds elsewhere. We saw that with the dramatic events at the Bataclan three years ago, when there was no shopping in stores or on the Internet for 15 days. »

Before adding:

« The (general) trend is still up 14%, which is the trend we’ve had for the past three or four years. There is no growth boom, plus 25 or plus 30, not at all. »

During the yellow vest crisis, e-commerce would not have particularly benefited from a postponement of sales from physical shops.

However, although there is no significant increase in e-commerce after such a crisis situation, the number of orders placed on the web continues to grow (by about 14% per year), while purchases in traditional shops are declining. This is partly due to the fact that online sales benefit from a faster and more significant post-crisis consumer response than physical stores.

With hindsight, the figures for post-attack e-commerce are also good. Beyond the immediate psychological trauma, the weeks following November 13 saw a resurgence in demand for internet shopping, for example.

Thus, in December 2015, Fevad announced:

” Sales are clearly back on the rise, there have been some great days for many sites, and to date about half of our members are reporting increases.”

An enthusiasm shared by Philippe Guilbert, managing director of the Toluna research firm, who declared at the time:

” These five weeks [précédents Noël 2015] have gained more than 800,000 customers for the merchant sites, while the physical stores have lost 2.5 million .”

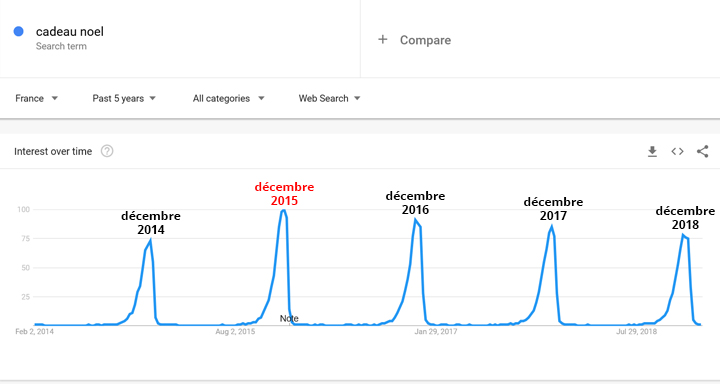

Source Google Trends – Search trends on the word “gift noel” in France from 2014 to 2018.

There is a peak in search activity in December 2015.

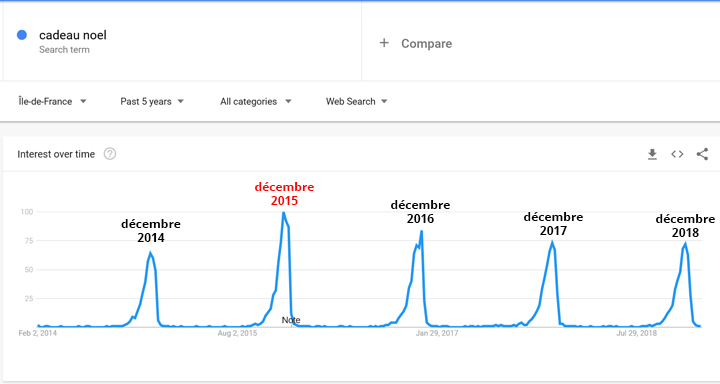

Source Google Trends – Search trends on the word “cadeau noel” in Île-de-France from 2014 to 2018.

There is a peak in search activity in December 2015.

Store to web vs web to store

In view of these figures, is it still necessary to remind people that being present online is a necessity? While many retailers have sworn by a web-to-store strategy, from now on, and even more so in times of crisis, store-to-web is also essential.

Web-to-store refers to all the marketing actions and devices implemented on the Internet in order to direct customers to the physical store. Click and collect to order online and pick up in store, the product locator to check the availability of a product in store, a store locator page to allow the Internet user to geolocate and find out the opening hours of the various points of sale, local referencing, virtual visits or even online appointment booking are some of the web-to-store devices.

Conversely, store-to-web consists of using digital in-store to enhance the value of the merchant’s site and encourage online purchases, particularly for items that are not or no longer available in stores. Store-to-web brings together several techniques, such as encouraging customers to order in-store, via their smartphone, a sales support tablet or an offer extension terminal.

Online vs. in-store shopping: motivations and reluctance

Today, the top three reasons consumers go to the store are:

- The possibility to try, see and touch a product. They often tend to use the store as a “showroom”, i.e. to check a product before buying it;

- impatience with the delivery time. Many do not want to wait for their product;

- the interaction and human contact, the personalized advice of the salesperson.

As for the reluctance to buy in stores, it does exist and is probably even more pronounced since France has become the target of terrorist attacks and the social movement of the yellow vests is rumbling.

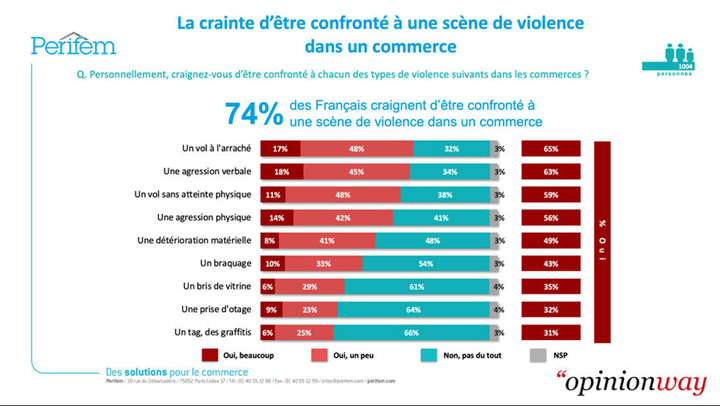

A recent study conducted by Perifem and Opinionway on the feeling of safety in the retail sector reveals that 74% of French people are afraid of being confronted with a scene of violence in a shop. More than one in four French people say they have already abandoned a purchase in a shop because of the feeling of insecurity. Yet the study was conducted just before the Yellow Vests movement.

Regarding online shopping, it is favored by several motivations:

- Avoiding the crowds in the store;

- not having to travel ;

- benefit from a wider choice.

As for the obstacles to buying online, the feeling of insecurity is also very present on the web, even if the fears are not of the same nature as in physical stores.

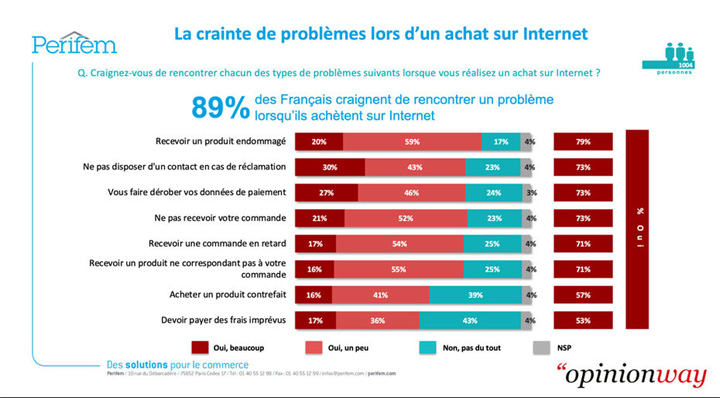

Still according to the Perifem/Opinionway study mentioned above, a large majority of French people (89%) confess to fearing problems when buying on the Internet. Among the fears expressed by respondents: receiving a damaged product, a delay or failure in delivery, customer service failure or theft of their payment details.

Also, read our tips on how to reduce the barriers to online shopping.

A survival guide for retailers in times of crisis

In order to avoid a drop in activity and mitigate the impact of a crisis on your business, we recommend 8 solutions designed to generate traffic, reduce the reluctance to buy online and thus promote sales on your e-commerce.

1 – Implement online promotions: adjust your pricing policy by offering discounts to boost sales.

2 – Counter the feeling of insecurity by reassuring the customer: about delivery, about your return and refund policy, about the security of payment.

Discover also our tips for effective return and refund policy.

3 – Make the purchase easier by offering express delivery and/or free delivery, and by working on your ordering tunnel.

4 – Increase your visibility in the SERPs by working on your SEO for local and voice search, and by setting up Google Shopping ads.

Find out how to adapt your e-commerce to voice search.

5 – Create Google Ads campaigns based on user location that redirect to landing pages optimized for online sales.

6 – Put as much information as possible about your products / services by adding customer reviews, product descriptions, good quality photos or even explanatory videos.

Find out also how to take care of your customer reviews.

7 – Animate your e-commerce by arranging your e-merchandising to highlight seasonal items.

8 – Put forward your customer service and, if possible, a chatbot or bot on messenger to respond quickly and efficiently to all customer requests.

Did you like this article?

Subscribe to our newsletter and you will receive our other articles once a month in your mailbox

Leave a Reply

You must be logged in to post a comment.